How Do I Consolidate Investment Accounts?

Reviewed by Michael J Boyle Fact checked by Hilarey Gould Illustration of a hand holding bone

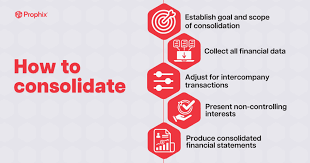

bills print The Balance/ Alice Morgan Dear Kristin, Over the times, I have dipped my toes in investing by subscribing up for different investing apps to test them and write about and partake my experience. I also entered shares of company stock at my first job out of council, which I still enjoy. Now, after all this time, I’ve a many different investment accounts one on Robinhood with just a many shares of a many different stocks; one on( a) real estate investing app; and also one with Fidelity, which houses the shares of stock that I got while working at my first job. Is it smart to keep all of these separate accounts and just let them grow? Should I consolidate them, and if so, how could I do that? I want to keep investing as I am only in my 30’s, but having similar little plutocrat( lower than$ 2,500) across the three different accounts apps feels like it’s meaningless. What do you suppose I should do? unfeignedly, audacious Investor Dear audacious, This is a great question and I suppose that for you, consolidating some of your investment accounts is presumably your stylish course of action. You mentioned you invest in real estate through one of your accounts, and you might want to continue your real estate investing through that platform. As for the others, you can consolidate your investments in stocks, bonds, and other securities. Having multiple brokerage accounts may be hard to manage and can add complexity to your investing strategy, which it sounds like you do n’t want right now. You said you want to keep investing, and the stylish strategy is to invest a harmonious quantum regularly, so it’ll be easiest for you to pick one brokerage account for all your requirements. By using one brokerage account, you’ll need smaller duty forms, wo n’t have multiple login details, and can invest regularly through one account. So spare yourself the trouble and consolidate! So how do you do that? numerous brokerages make it easy through the Automated client Account Transfer Service( ACATS). You fill out a Transfer Instruction Form( TIF) and shoot it to your new brokerage account indicating that you want to transfer means. The new brokerage establishment connections your old one, which also sends over the means. You might have to pay freights to do this, but overall, the process generally is n’t too delicate.1 If it goes easily, the transfer should only take three to five business days.2 It can come more complicated, however, depending on your portfolio.However, also you may have to vend the means and transfer the plutocrat to the new broker, which could spark capital earnings levies, If your old brokerage account holds means that the new bone

does n’t offer to investors. For illustration, if you bought Bitcoin through one account, you might not be suitable to move it to another brokerage establishment if it does n’t offer cryptocurrency investments.However, you’d have to vend your Bitcoin and transfer the cash over, If you still wanted to consolidate those investment accounts.However, you’d owe capital earnings levies, If you had made a profit on your Bitcoin. So when you’re investing in commodity that you ca n’t invest in on other platforms, it may actually be profitable to hold multiple investing accounts. And when deciding which investment account becomes your main account, consider how fluently you can make transfers, too. It seems like you’re on the right track, however, so surely keep it up! Good Luck! – Kristin still, Kristin is then to help, If you have questions about plutocrat. Submit an anonymous question and she may answer it in a unborn column. Was this runner helpful? Sources Part Of Making Cents Making Cents Making Cents Advice To Help You Manage Your plutocrat 1 of 56 Illustration of a jar of bone bills and change How Should I Start To Budget? 2 of 56 Illustration of two men talking Would Another Offer Force My Boss To Give Me a Raise? 3 of 56 Illustration depicting paying a nurse in cash Is It OK To Pay My nurse in Cash? 4 of 56 Illustration of a jar of change How important Should I Have In My Emergency Fund? 5 of 56 Illustration of a person holding shopping bags How Can I Enjoy the plutocrat I Earn Without Overspending? 6 of 56 Illustration depicting getting a job and earning income I Just Got a Job. What Should I Do With My Income? 7 of 56 Illustration of a person with shopping bags Can I Save further plutocrat and Still Have Some To Spend? 8 of 56 An illustration of a man allowing about plutocrat Should I Buy Fixed- Income means If I am hysterical of a Recession? 9 of 56 Illustration of a portmanteau with credit cards inside I Want To Get a Credit Card. How Do I Choose? 10 of 56 Illustration of a house and heaps of hundred bone

bills Should I Pay Off My Mortgage Beforehand? 11 of 56 Illustration of one bone

bills Which Should I Pay Off First My Debt or particular Loan? 12 of 56 Illustration of a house How Can I Earn Passive Income To Pay My Mortgage? 13 of 56 Illustration of a portmanteau with cash in it I Have Two Loans. Which Should I Pay First? 14 of 56 Illustration of a house Should I Pay Down My Mortgage Faster? 15 of 56 Illustration depicting a couple in debt My swain and I Can not Get Out of Debt. What Do We Do? 16 of 56 Illustration of a mound of books and scale cap I’m a Single mama. How Can I Help My Son Pay For College? 17 of 56 Illustration of a council graduate Biden Forgave My Pupil Loans. Now What? 18 of 56 Illustration of a council parchment and scale cap Can I Use a Retirement Account To Pay for College? 19 of 56 Illustration of a scale cap and mountains How Do I Avoid Paying Interest on Pupil Loans? 20 of 56 Illustration of house keys Should I Buy a House Now? Or stay for Prices To Crash? 21 of 56 Illustration depicting a house and a woman Should I Buy a House in a dealer’s request? 22 of 56 Illustration of a hand holding bone

bills How Do I Consolidate Investment Accounts? 23 of 56 Illustration of a mound of hundred bone

bills How Do I Earn Interest on My Savings Without Investing? 24 of 56 Illustration of a hand with a one bone

bill How Do I Start Investing When I am hysterical To Lose plutocrat? 25 of 56 Illustration depicting investments losing plutocrat My Investments Are Losing plutocrat. What Should I Do? 26 of 56 Illustration of cryptocurrency Should I Buy Crypto? 27 of 56 An illustration shows over leaning arrows set over a distance of graph paper and several U.S. coins, including nickels, peanuts, and diggings. requests Are Down. Should I Stop Investing? 28 of 56 A woman sits and reads a book on the left wing. On the right plutocrat flows into a jar. How Do I produce Passive Income? 29 of 56 Illustration depicting investing I Want to Invest — But How important, and What Do I Buy? of 56 Hands hold up bone

bills with a graph in the background. Question marks hang over the trend line. Should I Invest Now, or stay Until the request Sinks further? of 56 Illustration of two hands clinging bone

bills Should I Roll Over My Old 401( k) Accounts? 32 of 56 Illustration of a coconut with a straw in it I Do n’t Have Enough Saved for Retirement. Now What? 33 of 56 Illustration of bone

bills flying My Retirement Accounts Are Losing plutocrat. What Do I Do? 34 of 56 Illustration depicting how lagniappes are tested How Are My lagniappes tested? 35 of 56 Illustration of bills I Have n’t Paid My 2021 levies.